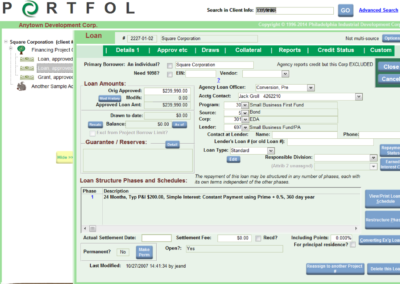

LOAN SERVICING

Portfol lets you manage and service loans more efficiently.

Portfol’s loan servicing functions can generate invoices, bill daily interest during the drawdown phase, and print ages A/R reports, delinquency notices, your trial balance – and lots more!

- Easily handles mortgage, simple-interest, variable rates or line-of-credit type amortizations

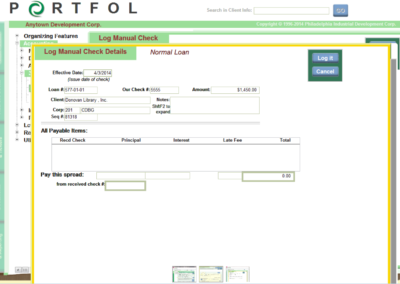

- Posts repayment checks to exact principal, interest, late or service fees

- automatically calculates late fees on delinquent loans

- Produces full monthly and annual cash statements and trial balances

- Allows removal of bounced checks and other adjustments

- Recalculates loan schedules during work-outs (i.e. applying moratoriums and/or re-amortizing for different interest rates or terms)

- Maintains full amortization schedules – no matter what changes have been made along the way. See at a glance what happened and when.

- Allows you to report a borrower’s credit history by generating the Metro 2 formatted data file

- Set up loans funded from multiple sources and even see the repayment schedule for the sub-loans

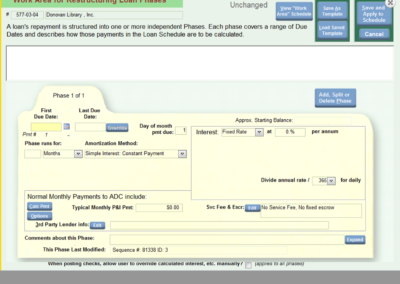

PHASES OF A LOAN: FLEXIBILITY IN SCHEDULING

The only system available where you can maintain a full history of every change made to a loan’s repayment structure. Portfol can create or restructure a loan using different interest rates, amortization methods, or even payment amounts. Each phase is independent of the other and can describe any part of the loan’s life. Choose from 13 Amortization Methods including Traditional Mortgage, a Line of Credit, Interest-only or Capitalizing payments.